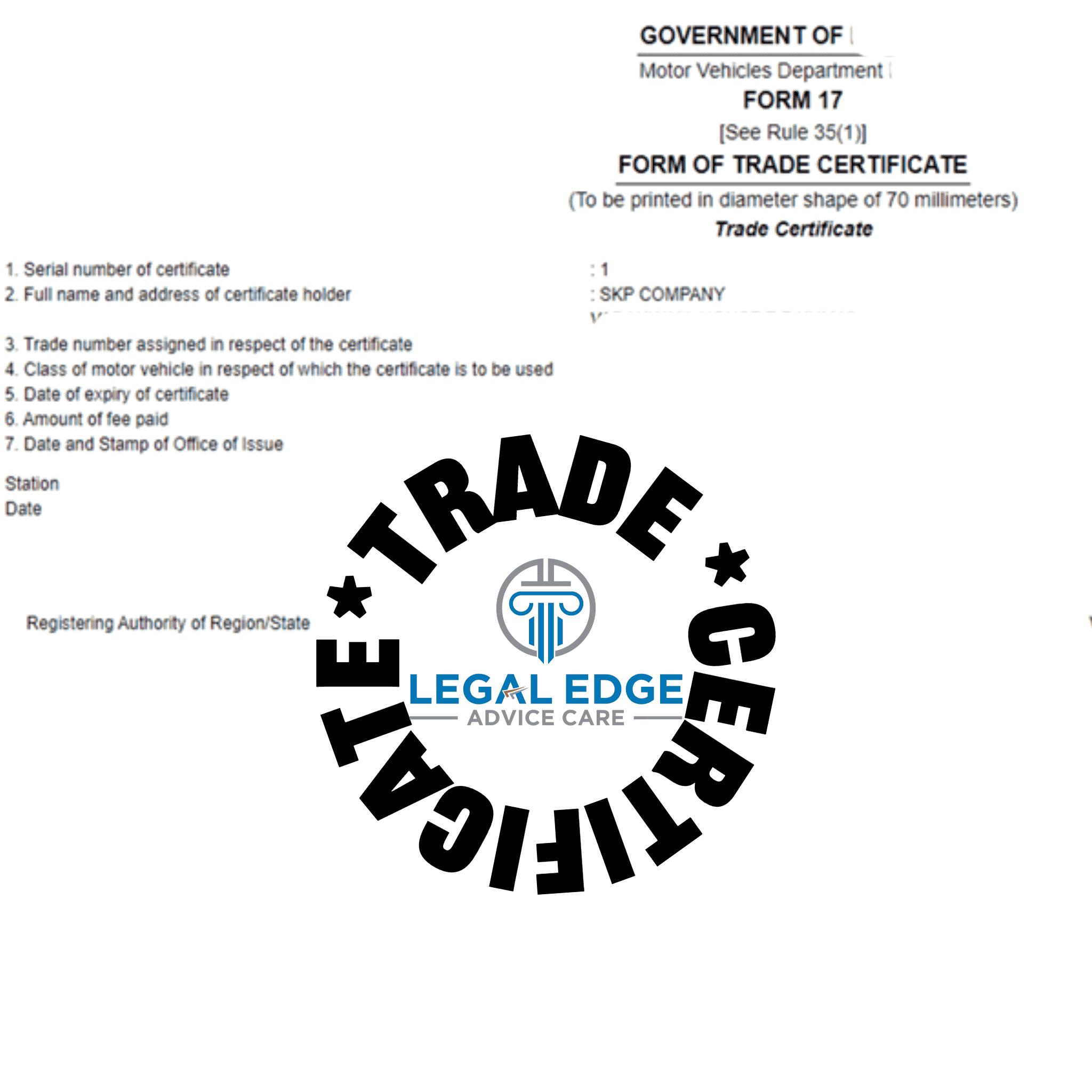

Trade Certificate

Motor vehicle in the possession of the dealer shall be exempted from the necessity of the registration subject to the condition that he obtains a trade certificate from the registering authority.No holder of a trade certificate shall deliver a motor vehicle to a purchaser without registration, whether temporary or permanent.A trade certificate granted or renewed under rule 35 shall be in force for a period of twelve months from the date of issue or renewal there of shall be effective throughout India.

Restrictions on use of trade certificate or trade registration mark and number

Purposes for which motor vehicle with trade certificate may be usedGuidelines

any other motor vehicle of a specified description

Documents required

Reference

Documents marked with asterisk (*) may be required in some states.